LOS ANGELES — Felony Insurance-fraud was front-and-center as investigators were enlisted for some remarkably-large red flags, allegedly perpetrated by a Los Angeles business owner. That’s when the California Department of Insurance, the largest consumer-protection agency in the state, (since its establishment in 1868,) and headed by state-elected executive Insurance Commisioner Ricardo Lara, took action.

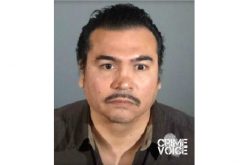

Originally, a routine audit for the policy-year of November 1, 2014, to November 1, 2015 revealed that payroll wages were actually $881,593 – not $8,035. In addition to this, a mere one employee – reported by owner Marion Piggee, Jr. (68) of Los Angeles – raised eyebrows.

Next, the State Compensation Insurance Fund (SCIF) filed a suspected insurance-fraud claim with the Department of Insurance on 11/28/2016. While alleging potential insurance fraud, SCIF reported that Piggee, as owner of “Center for Behavioral Change” (an adult residential care facility) allegedly underreported employee payroll in order to reduce the proper rate of insurance premiums owed to SCIF.

This was where an investigation by the Fraud Division – which delves into suspected fraud committed by consumers or organized criminal elements perpetrated against insurance companies – found Piggee’s business had left out a rather-large fact. Workers’ Comp insurance had only been purchased for one facility – and left out the eight more facilities acquired during that time.

Of particular note was the investigators’ reveal of not just the one listed employee, but 60 unreported ones. That failure to disclose resulted in Center for Behavioral Change’s payroll underreported by $5,982,410, which resulted in a premium loss to SCIF of $1,017,937.

Piggee’s alleged fraud-scheme attempt failed to illegally shrink his business’s workers’ compensation insurance premium by over $1 million. Consequently, the owner was busted for the many felonious insurance-fraud moves – while allegedly underreporting employee payroll by nearly $6 million.

This week’s California Department of Insurance announcement declared that Piggee was arraigned on seven counts of insurance fraud at Los Angeles Superior Court on 04/06/2021. The Los Angeles County District Attorney’s Office is prosecuting the case, where Piggee, as a result of his behaviors, would most probably be sent to another quite-different center for behavioral change.

MISSION STATEMENT: The State Compensation Insurance Fund is a workers’ compensation insurer that was created as a “public enterprise fund” by the U.S. state of California, and today has partial autonomy from the rest of the state government. It is required by state law to maintain its headquarters in San Francisco, but has regional offices all over the state.

Insurers collect $340 billion in premiums annually in California. Since 2011 the California Department of Insurance received over 1 million calls from consumers, and helped recover over $469 million in claims and premiums. Those needing help are encouraged to visit the Department of Insurance website at www.insurance.ca.gov or call the Consumer Hotline 800-927-4357. Teletypewriter (TTY), are asked to please dial 800-482-4833.