Former loan officer admits wire fraud scheme

FRESNO — A former Bakersfield loan officer acknowledged taking part in a scheme to defraud mortgage lenders and will participate in a government probe into his former employer.

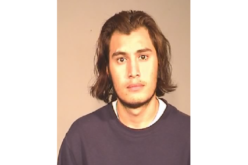

Jerald Allen Teixeira, 29, pled guilty in federal court Tuesday to one count of wire fraud. Teixeira was formerly a loan officer at Tower Lending, a mortgage brokerage company that was affiliated with Crisp & Cole Real Estate and previously owned by Crisp & Cole’s owners, both in Bakersfield.

As part of his plea agreement, Teixeira agreed to cooperate in the FBI’s ongoing investigation.

As part of his plea agreement, Teixeira agreed to cooperate in the FBI’s ongoing investigation.

According to the assistant U.S. attorneys handling the investigation, Teixeira admitted in his plea that, between October 2004 and January 2007, he and other employees at Crisp & Cole and Tower Lending, as well as people outside the two businesses, executed a scheme to deceive lending institutions into funding mortgage loans on the basis of false information.

Teixeira said he and the co-conspirators did this by submitting materially false and fraudulent statements in mortgage loan applications and related documents to obtain loans from the lenders for borrowers’ purchases of real property. Teixeira said he and others lied about borrowers’ income, employment status or occupation, and the borrowers’ intent to reside in the properties as owner-occupiers.

In some instances, Teixeira said a borrower’s income would at times be falsely inflated on the loan application and related documents if it appeared that the borrower would not qualify for a particular loan based on the borrower’s actual income.

During a two-year period, Teixeira claims he obtained loans to finance the purchase of approximately 11 real properties with a total purchase value at the time of approximately $4.4 million, and refinanced the mortgage on one of the properties. In order to qualify for these loans, Teixeira fudged or omitted information in almost all of the loan applications, misstatements that included his own income and outstanding liabilities, and lying about his intent to use certain properties as owner-occupied residences.

A number of the properties purchased with the loan proceeds were subsequently foreclosed upon after loan payments were not made when due.

“The United States Attorney’s Office continues to pursue those responsible for the mortgage fraud schemes that have contributed to the devastation in real estate and financial markets,” said U.S. Attorney Lawrence G. Brown in a statement.

To further the prosecution of mortgage fraud cases arising out of the southern half of the Central Valley, in 2009 the U.S. Attorney’s Office and the FBI created a Mortgage Fraud Task Force in Fresno, comprised of both federal and local law enforcement agents and prosecutors.

Teixeira is scheduled to be sentenced on March 22 at 1:30 p.m. The maximum statutory penalty on the wire fraud charge is 20 years in prison, and a criminal fine of $250,000. However, the actual sentence will be determined at the discretion of the court after consideration of the Federal Sentencing Guidelines, which take into account a number of variables, and any applicable statutory sentencing factors.