Second man charged in $40M Folsom Ponzi scheme

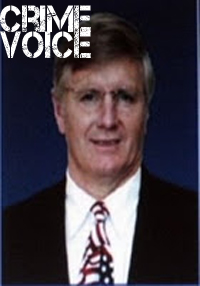

Kenneth Kenitzer, 66

SACRAMENTO — State and federal authorities have found a second person to hold accountable for a $40 million investment fraud scheme that targeted 150 investors in northern and eastern parts of California and is still under investigation.

On Wednesday, Kenneth Kentizer, 66, of Pleasanton became the second man to come under suspicion for a massive Ponzi scheme that masqueraded as a hedge fund investment program called Equity Investment Management and Trading, Inc. Kentizer agreed to a plea deal that will require him to plead guilty to mail fraud and money laundering charges and cooperate in the ongoing investigation. His plea deal is subject to court approval.

In March, Anthony Vassallo was charged with multiple counts of mail fraud and money laundering as part of the same investigation.

This case is the product of a joint investigation by the Federal Bureau of Investigation and the Internal Revenue Service-Criminal Investigations. The United States Securities & Exchange Commission assisted with this case.

Court documents allege Vassallo and others offered and sold investments with the false claim that investors would make an annual return of up to 36 percent with virtually no risk of loss. But the money wasn’t invested as represented. Instead, court documents allege, Kentizer, Vassallo and others operated EIMT as a vast Ponzi scheme that generated more than $40 million from victims in the eastern and northern districts of California.

According to court documents, potential victims were identified through “sub-fund managers” and issued a “Private Placement Memorandum.” Many investors mailed their memorandums to Kentizer at his personal residence. Vassallo falsely represented that he had proprietary software that allowed him to buy and sell stock options with little risk of loss. Vassallo recruited many of the sub-fund managers and investors from his church. Kentizer, Vassallo and others told investors their funds would be traded on the Russell 2000 index through Trade Station. Trade Station is a licensed securities broker-dealer and a registered futures commission merchant, and was in no way part of the fraud.

Around September 2007, all trading stopped and funds were withdrawn from Trade Station. Nevertheless, Kentizer and Vassallo continued to falsely tell investors that their money was invested and was making a high rate of return. Kentizer, Vassallo and others kept the fraud going by providing simulated information to investors to make it appear that funds were being invested and EIMT had $50 million on deposit with Trade Station.

A simulated trade session is when a person can do simulated trades with simulated account funds to develop strategy. When a person is trading in a simulated trading session, that session is given a simulated account number. Vassallo fraudulently provided this simulated financial information to investors as proof of funds on deposit.

When investors asked about the status of their investments and distributions, Vassallo falsely told investors that there were “problems with the Trade Station platform” and that he could not invest funds in November 2008. Further, when investors sought to have funds returned, Vassallo told them that Trade Station had contacted the SEC and that the SEC froze the funds in the accounts. Both Trade Station and the SEC say these representations by Vassallo were false.