FBI: Former mortgage broker used business front to charge bogus liens

SACRAMENTO — Facing allegations that he created a business front to funnel nearly $1.8 million in bogus lien payments to himself and others, a former Redding mortgage broker pled guilty Monday to one count of mail fraud.

The Federal Bureau of Investigation claims 31-year-old Joshua Gervolstad created a bank account for a phony entity called “TPG Investments,” which he used to collect $1,798,888.91 in fraudulent payouts for liens that did not exist. This conduct affected mortgages worth more than $5.4 million, said Assistant United States Attorney Matthew D. Segal. At least three of the five properties located in Redding and Lodi were foreclosed as a result.

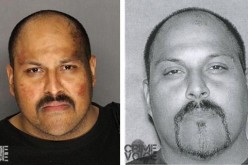

Joshua Gervolstad

Segal said the mortgage fraud scheme involved Gervolstad submitting inflated appraisals and false lien documents for use in closing purchase transactions involving the five different properties. The closing statement for each property contained fraudulent papers requiring the payoff of a non-existent lien to TPG Investments, which Gervolstad controlled and used its bank account to divert mortgage loan funds to himself and others.

“The vigorous pursuit of real estate professionals who perpetrated mortgage fraud is a top priority for federal authorities in this region,” U.S. Attorney Lawrence G. Brown said in a statement.

Gervolstad is scheduled to be sentenced by U.S. District Judge William B. Shubb on Dec. 14 at 8:30 a.m. The maximum statutory penalty for a violation of mail fraud is 20 years in prison, a $250,000 fine, and restitution of the full amount of the loss. The actual sentence, however, will be determined at the discretion of the court after consideration of the Federal Sentencing Guidelines, which take into account a number of variables and any applicable statutory sentencing factors.